How Credit Score is Determined

Getting the facts straight about credit restoration and the credit industry as a whole can be a daunting task. There is a lot of misinformation about credit and many people are under the impression that there is nothing they can do to fix their credit score.

We are here to educate you about credit so you won’t be in the same situation again. Our goal is to help you improve your credit score and maintain it. Learning about your credit and how it affects many aspects of your life is the first step towards improving it.

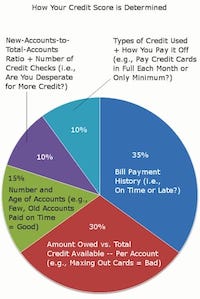

With so much emphasis on your credit score, it is important to understand how the score is calculated. Commonly referred to as your FICO (Fair Issac CO) Score, your credit score is a summation of complex algorithms used to determine your exact score. While the formulas are protected, we are given approximate percentages that help us understand what goes into your score.

35% PAYMENT HISTORY - The largest factor is your basic payment history. This is the number of unpaid bIlls that you have, any bills sent to collection, bankruptcies, etc. The items that are most recent have the most impact.

30% OUTSTANDING DEBT - Are your credit cards maxed out? High balances, or balances close to your credit limit can negatively affect your score. Keep balances below 35% of your credit limit.

15% LENGTH OF CREDIT HISTORY - How long have your accounts been open? The longer the account has been open, the better.

10% RECENT INQUIRIES - Every time you apply for credit of any kind, you create an inquiry on your credit report. Multiple inquiries negatively affect your score.

10% NEW CREDIT - How many current loans you have and the value of these loans. Three major bureaus dominate the market for supplying American lenders with credit scores. When you apply for credit, it does not come directly from FICO; instead each bureau has its own version with its own name.

CALL TODAY FOR A CONSULTATION TO REVIEW YOUR CREDIT SITUATION

(888)557-0363

craklients@gmail.com